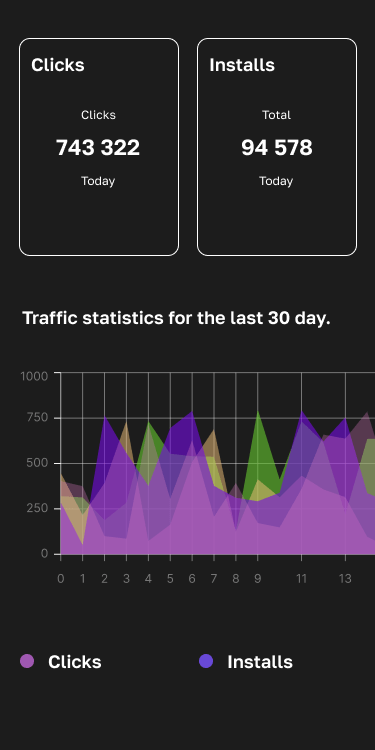

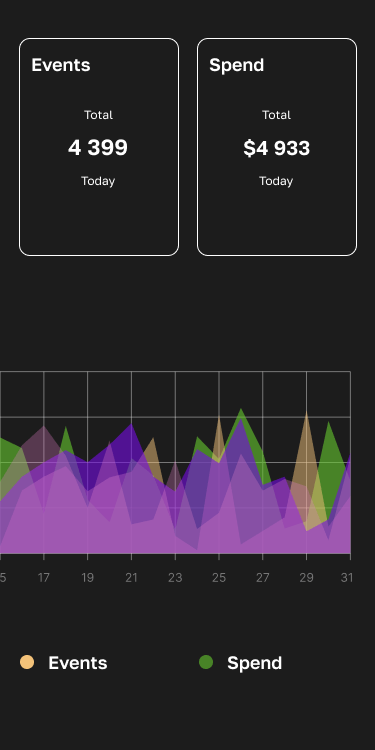

Over the past two years Mi Ads has quietly evolved from a “China-only curiosity” into one of the world’s most sophisticated, programmatic-ready OEM traffic sources. Xiaomi’s ad platform now reaches more than 700 million monthly active users (MAU) in 200 + countries, offers first-screen placements other networks simply cannot match, and delivers CPIs that can undercut mainstream channels by double-digit margins. Below is a July 2025 deep dive that brings UA and growth teams fully up to speed.

1. Global scale & business momentum

Xiaomi reported 718.8 million global MAU in March 2025, up 9.2 % YoY.

More than 420 million of those users are now outside mainland China, thanks to HyperOS roll-outs in 200 + markets.

Ads have become the single largest Internet-services line for Xiaomi, hitting RMB 6.6 billion (≈ US$ 910 million) in Q1 2025, +19.7 % YoY.

2. Inventory: from OOBE to lock-screen takeovers

- Out-of-box & first-run flows put app suggestions in front of every new device owner.

- System apps (GetApps store, Themes, Security, Cleaner, Weather) and the -1 feed provide always-on reach.

- Lock-screen “Vertical Ads”— launched globally in late 2024 — deliver high-viewability full-screen units; AEGEAN’s Greek launch campaign was among the first case studies.

- In-app SDK supply supplements system inventory, giving performance buyers depth across gaming, utility and video categories.

3. Creative formats & specs

Mi Ads supports native, banner, interstitial, rewarded-video, splash and wallpaper units. Key sizes are 1200×628 & 600×314 images, ≤ 500 kB, 30-char titles, 80-char descriptions, 15-char CTAs. Videos may run up to 30 s at 10 MB. Newly added lock-screen units inherit the same creative spec for streamlined production.

4. Buying rails & optimisation levers

| Rail | Details |

| Self-serve UI | Campaign → Ad-group → Creative; performance or branding objectives, daily/lifetime budget |

| Programmatic RTB | OpenRTB 2.5 endpoint, first-price auctions |

| Marketing API | REST interface for build–bid–report workflows; supports oCPC & bulk ops |

| Smart bidding (oCPC) | Auto-bids toward CPA/ROAS; incentive program launched May 2025 to offset learning costs |

| Post-link Metric Optimisation | Optimise for D1 retention, registration or purchase once 30-50 events/day accrue |

5. Targeting & data signals

Advertisers can combine geo (country → city), device model, OS version, carrier, network type, user-status (new/current/lapsed) and interest tags. Custom audiences upload via ID lists; placement-level controls let buyers isolate lock-screen, splash, info-stream, icon and rewarded inventory.

6. Performance benchmarks

Independent agency campaigns report CPIs 15–30 % lower than “standard channels” such as Meta & Google UAC. When oCPC is tuned to a post-install event, install-to-event conversion rates improve 3–5× versus CPI-only bidding. These deltas stem from lower auction pressure, first-screen visibility and deterministic device IDs (GAID/OAID) that remain available even as Android Privacy Sandbox ramps up.

7. Privacy, brand safety & user controls

Mi Ads enforces Xiaomi’s content guidelines (adult, gambling, medical and political exclusions). HyperOS settings still let users disable personalised ads—Mi Ads honours those signals at request time. Attribution relies on GAID/OAID today, with Sandbox testing underway ahead of Android 15 GA.

8. Quick-start checklist for UA teams

- Get whitelisted by your Xiaomi AM or an authorised agency.

- MMP set-up: append click/impression macros for GAID/OAID.

- Launch with icon/native placements at high bids for 48 h to exit the learning phase.

- Switch to oCPC once 30 + daily conversions fire.

- Layer lock-screen & splash for burst or brand moments, capping frequency via API.

- Run incrementality tests each quarter to isolate Mi Ads lift in your blend.

Outlook

With triple-digit revenue growth, full OpenRTB compatibility and exclusive first-screen units, Mi Ads has crossed the line from “experimental OEM channel” to a must-have pillar in the 2025 Android UA stack. Brands that master Xiaomi’s smart-bid and placement mix today will bank a durable cost and scale advantage long before slower competitors catch on.